How Do The U.S. And Canadian Markets For Pre-Roll Marijuana Products Differ? (Op-Ed)

From toxifillers.com with love

“It is more and more clear that pre-rolls are shaping the future of the cannabis market on both sides of the border.”

By James Valentine, Custom Cones USA and DaySavers

Cannabis continues to be a multibillion-dollar industry in Canada and the U.S., and while both countries share the same top product categories—flower, pre-rolls and vape pens—market maturity and consumer preference vary greatly, creating two distinct markets with different product landscapes and market shares between the categories.

For a detailed understanding of the current state of these two pre-roll markets, Custom Cones USA partnered with cannabis industry analytics firm Headset to analyze retail point-of-sale data from 16 markets across both nations.

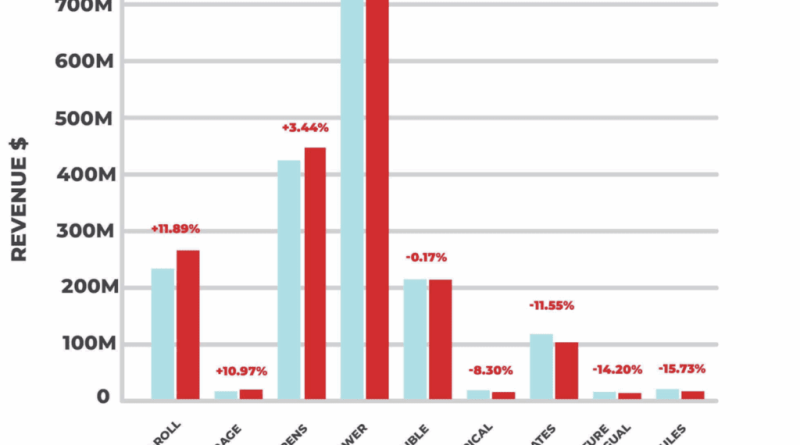

Canada’s cannabis market saw its first revenue downturn since national legalization in 2018, with sales figures falling 3.27 percent due to staggering declines in flower and edible sales totaling $128 million. Pre-rolls sales on the other hand, continued to grow.

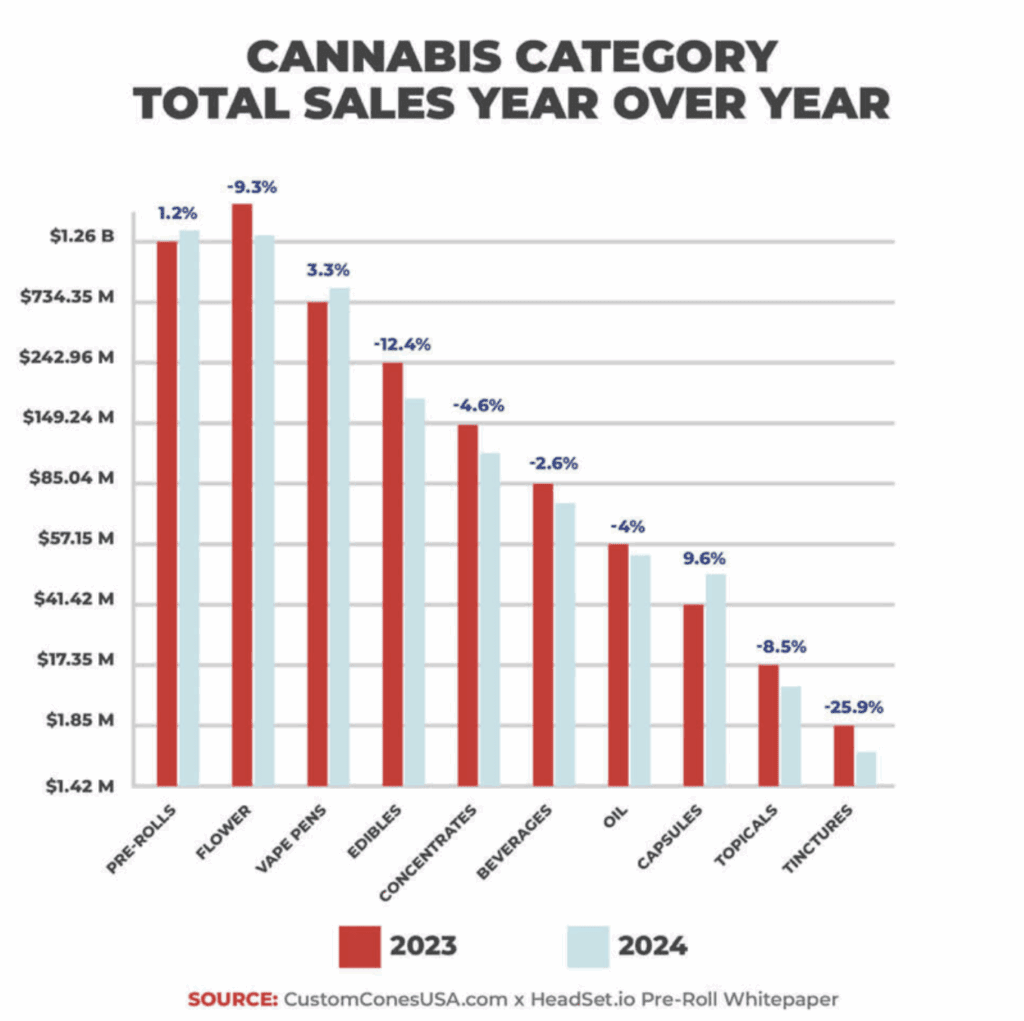

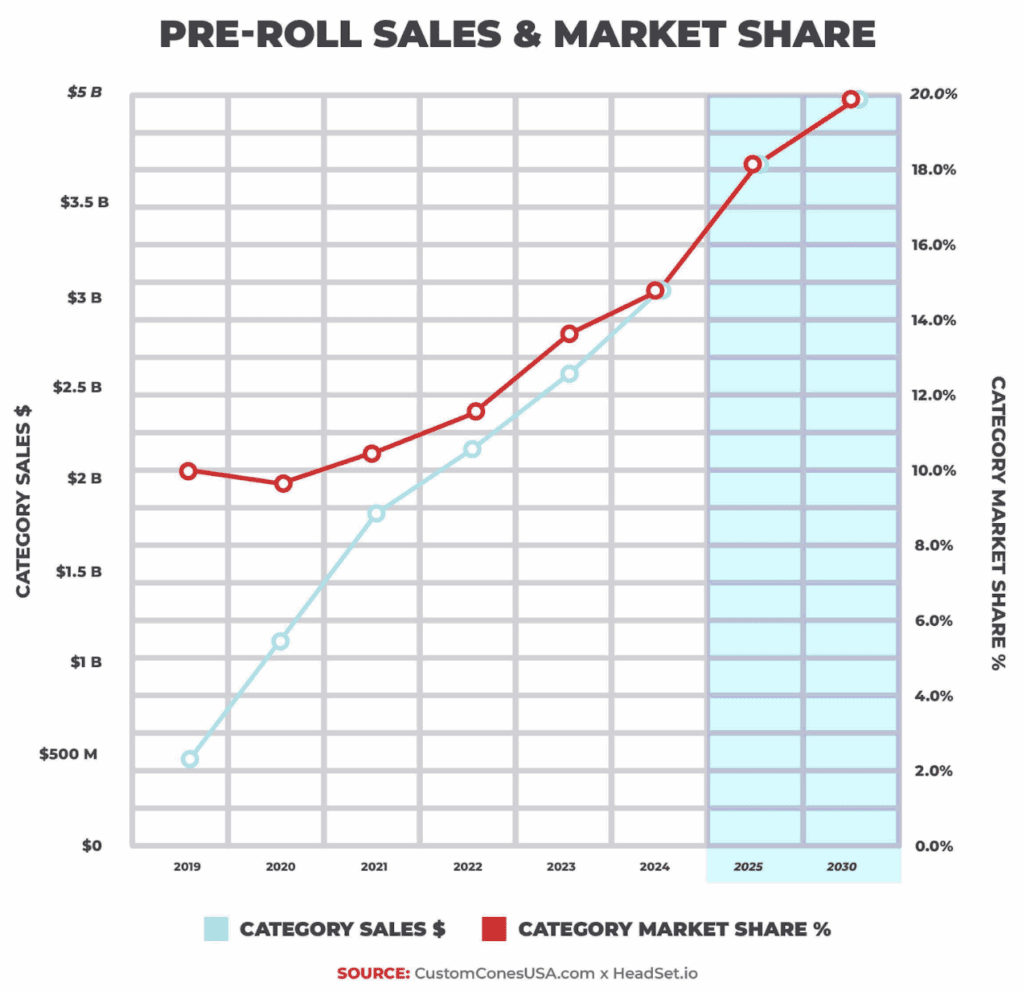

With recreational markets opening more gradually in the states since Colorado in 2012, the U.S. market continues to set sales record year after year, and pre-rolls are the fastest growing cannabis product category over the past two years, up 12 percent in 2024.

Though overall cannabis revenues dropped in Canada last year, pre-rolls grew a modest 1.2 percent year-over-year (YoY), while flower and edibles lost 9.3 percent and 12.4 percent in total sales, respectively. While still growing, the pre-roll category is showing signs of saturation, as the previous year the category saw a 38 percent growth in revenue.

In stark contrast, U.S. pre-roll sales amassed $4.1 billion in 2024, adding 2.7 percent market share while increasing monthly sales revenue from $181 million in January 2023 to $257 million in June 2024.

But it should be noted the scale of the two markets is difficult to compare. Canada moved 68.7 million pre-roll units last year, while the American market sold a staggering 324.5 million units.

While sales numbers often reflect population sizes, the difference between pre-roll market share of the two countries jumps off the page. In Canada, that number is double (32 percent) that of the U.S. (16 percent). And for the first time in Canada’s market, pre-rolls eclipsed flower as the top-selling cannabis consumer product for a full six months. Though by year’s end, flower regained the top spot, by just a 0.25 percent market share lead over pre-rolls, or only $11.4 million more in sales.

In the states, however, the market share gap between pre-rolls and flower is vast, with flower holding a 41 percent market share compared to pre-rolls’ 14 percent. To put U.S. pre-roll growth in perspective, sales revenue has increased every year over the past five years, up to $3.1 billion in 2024 compared to $469 million in 2019.

Pre-roll sales are expectedly far higher in the U.S. compared to our neighbors to the north, but their dominance in Canadian market share conveys the real story: Canadians prefer pre-rolls 2-to-1 over Americans.

Consumer pre-roll preference

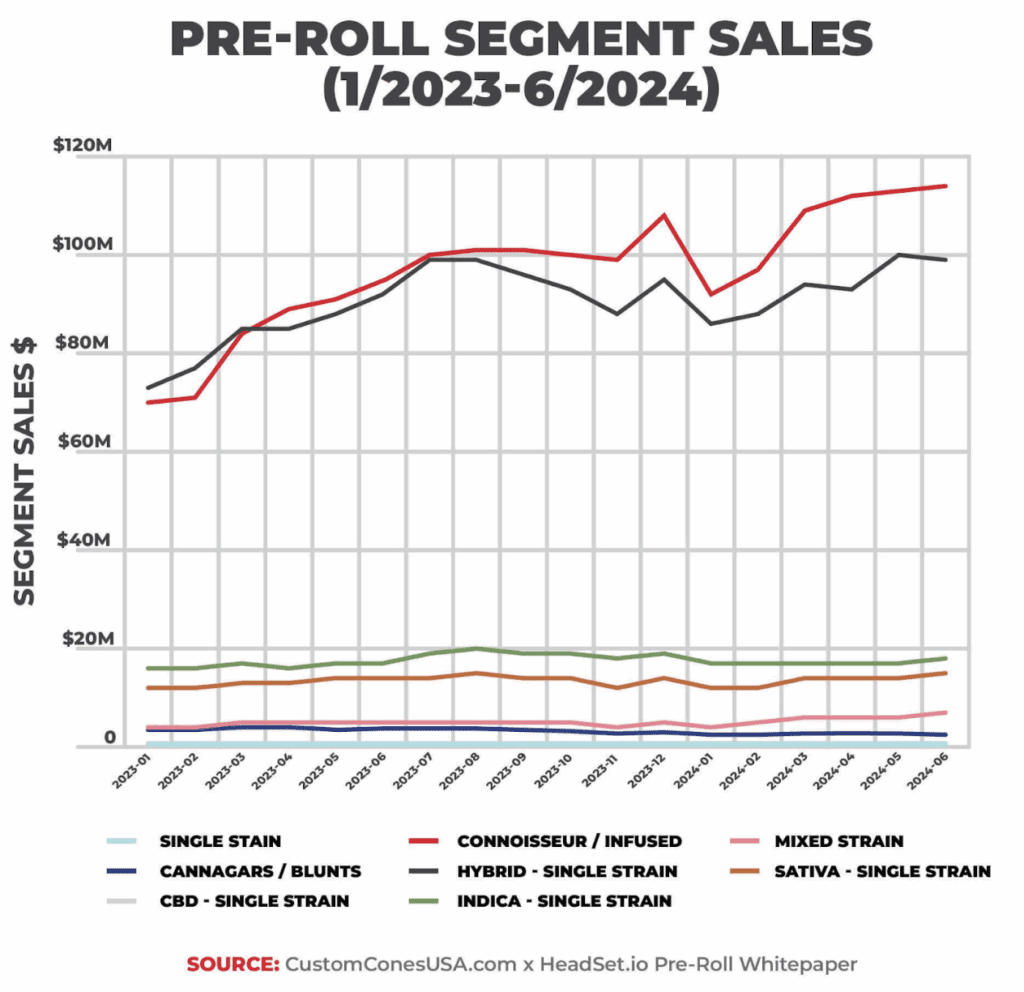

Despite the wide discrepancy between American and Canadian pre-roll market share, segment preference within the category is very similar between the two nations, with hybrid, single-strain pre-rolls inching out infused pre-rolls in Canada while infused pre-rolls edged out hybrids in the states.

Canadian hybrid, single-strain pre-rolls brought in $483 million, up 8.3 percent YoY and $37 million in total sales. In the U.S., hybrid sales were up 35 percent between the start of 2023 and the first half of 2024, bringing in $1.64 billion over that time.

American infused pre-rolls pulled in a massive $1.75 billion in sales over that time, controlling 44 percent of pre-roll market share while Canadian infused pre-rolls saw a 6.5 percent increase from 2023 to 2024 with sales totaling $457 million.

Indica and sativa single-strain pre-rolls sit at No. 3 and No. 4 in both markets, with indica inching out sativa in both markets by about 10 percent. In Canada, hybrid and infused pre-rolls outsell these segments by around 300 percent, while that number in the states is around 500 percent.

In both markets, the remaining pre-roll segments—mixed Strain, CBD, single strain and blunts—make up just 5.5 percent of pre-roll sales in Canada and 7 percent in the states.

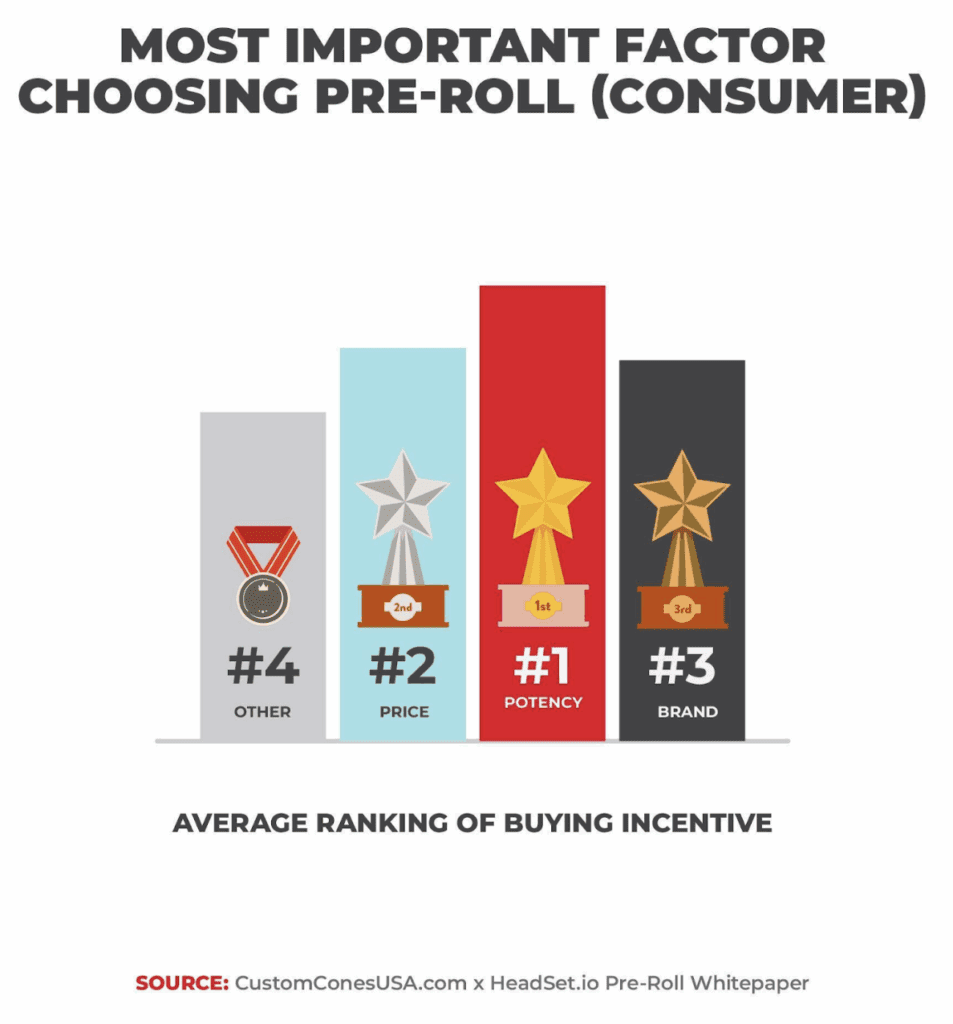

But in both countries, no matter the strain nor segment, potency tops the list as the most important factor consumers consider when choosing pre-rolls, followed closely by price, strain and brand loyalty.

An interesting fact about both American and Canadian pre-roll markets is that consumer preference for consumption-ready products peaks in the warmer months, with pre-rolls seeing their highest yearly market share in late spring, summer and early fall. In Canada, this trend led to pre-rolls becoming the highest-selling cannabis product during those months, peaking in July with a 3 percent lead over flower.

While flower remained the top-selling Canadian cannabis product in 2024, that lead has shrunk from 4 percent in 2023 to 0.25 percent in 2024, leading us to predict that pre-rolls will be the number one sales category in the Canadian market in 2025.

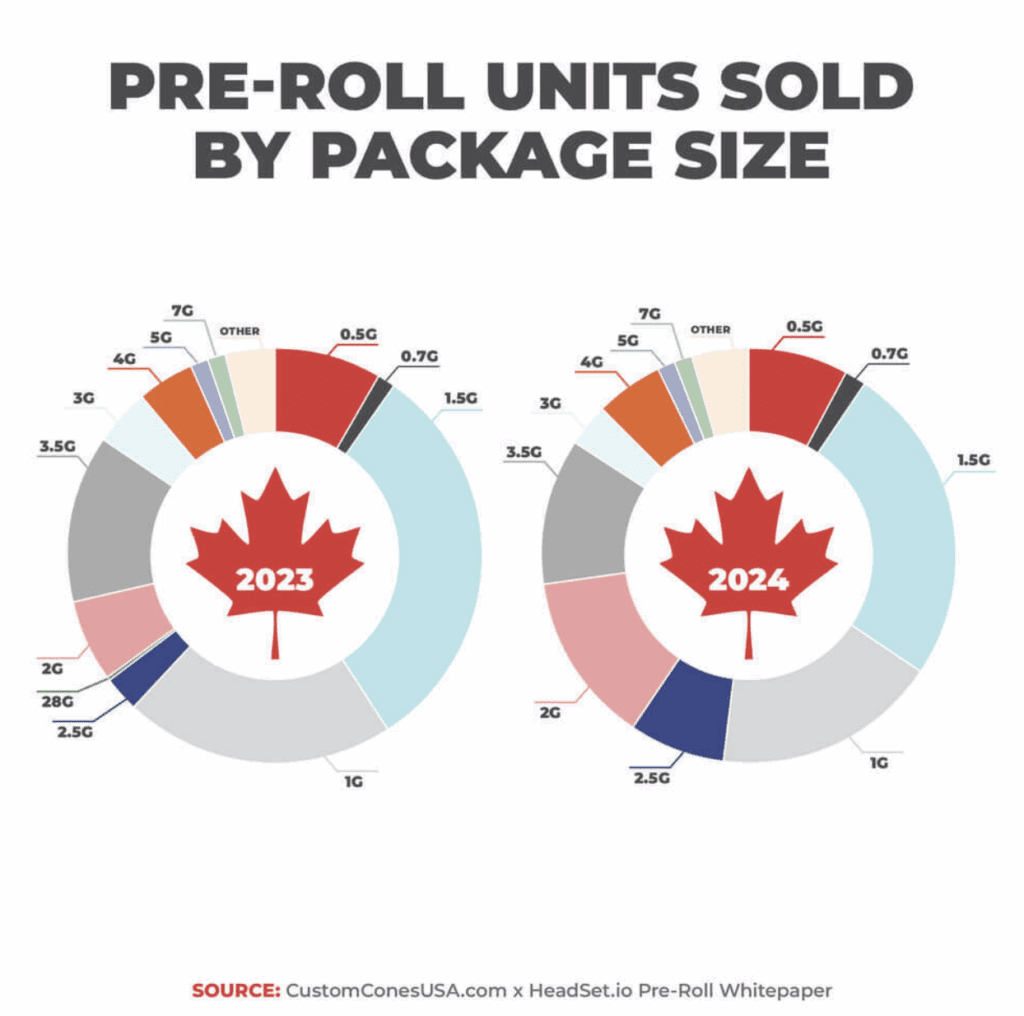

Package size preferred by consumers

Multi-packs reign supreme in Canada, accounting for 85 percent of pre-roll market share while the classic 1-gram single pre-roll accounts for just 11 percent of sales. In the U.S., multi-packs account for nearly 50 percent of the pre-roll market, with sales increasing 43 percent in 18 months between the beginning of 2023 and the middle of 2024.

The single 1-gram pre-roll is the top American preference for pre-roll package size, accounting for 42.3 percent of sales, nearly four times that of Canadians.

Over 15,000 new pre-roll products entered the U.S. market in 2024, with nearly 8,900 of those being the dominant single, 1-gram pre-roll. Approximately 5,000 new multi-pack products were released over the same time period.

The most popular multi-pack size in the states is the 2.5-gram 5-pack, representing 16 percent of total pre-roll sales YoY. In Canada, the 1.5-gram 3-pack is the most popular, accounting for 27 percent of sales. But Canadian multi-pack preference is beginning to look more like the American preference, with 1.5-gram packs losing 7.1 percent market share while 2- and 2.5-gram multipacks both gained 3.3 percent market share YoY.

Producers are adapting to this change in multi-pack preference. In 2024, Canadian producers increased their 2-gram and 2.5-gram pre-roll offerings by 85 percent, releasing 282 additional products in 2024. In the states, 32 percent of new products were multi-packs compared to 68 percent of single pre-roll products, with nearly 87 percent of those being the popular 1-gram single-pack.

Pre-roll price comparison

The average pre-roll product in Canada ($18.43 CAD) sells for well over twice the price of an American pre-roll ($6.50 USD), due to the overwhelming preference of multi-packs from consumers, with infused multi-packs driving that average higher with the addition for cannabis concentrates in pre-rolls.

For context, the average Canadian infused pre-roll item price is over $7 more than the highest-selling hybrid, single-strain segment. In fact, the average pre-roll price in Canada rose $0.41 YoY, implying an increase in infused products on the market.

In the U.S., despite the surge in ultra-premium, high potency Infused products that command luxury prices, the average pre-roll price dropped $0.70 in 2024, a 16.7 percent decline. The infused segment also saw a 23 percent price decrease YoY, falling from $11.50 to $8.80, a substantial drop.

But while the average item price for pre-rolls in the States is declining, the number of pre-rolls sold has skyrocketed, with an additional 10 million units sold per month from early 2023 to mid-2024, reaching 26 million units sold in June 2024 compared to 16 million at the start of 2023.

Despite changes in the landscape, pre-rolls continue to be a top selling category in both countries in both unit sold and total sales revenue.

2025 pre-roll outlook

Following years of consistent growth, pre-rolls are poised to continue their growth in revenue and unit sales in 2025 in both Canadian and American markets.

With modest growth in Canada in 2024 (1.2 percent), it may seem like growth may be reaching saturation. But with flower losing over 9 percent of market share in 2024, equating to over $145 million, we’re confident that pre-rolls will not only grow in 2025, but also flip flower as the top cannabis product category in Canada.

In the U.S., if the pre-roll market continues to increase at its current pace, we estimate that pre-rolls will add an additional 2 percent to 3 percent market share through 2025, equating to well over $4 billion in yearly total pre-roll sales, particularly in maturing markets. Infused pre-rolls have added 10 percent market share within the segment since 2019, and we expect that growth to continue, with current infused market share sitting at around 44.5 percent.

Consumers in Canada tend toward pre-rolls at a rate of 2 to 1 compared to the U.S. despite the premium price point for multi-packs, while relative sales growth in the U.S pre-roll market (11.9 percent) was about ten times that of their neighbors to the North (1.25 percent). But no matter the market, pre-rolls are a top category for consumers and producers alike.

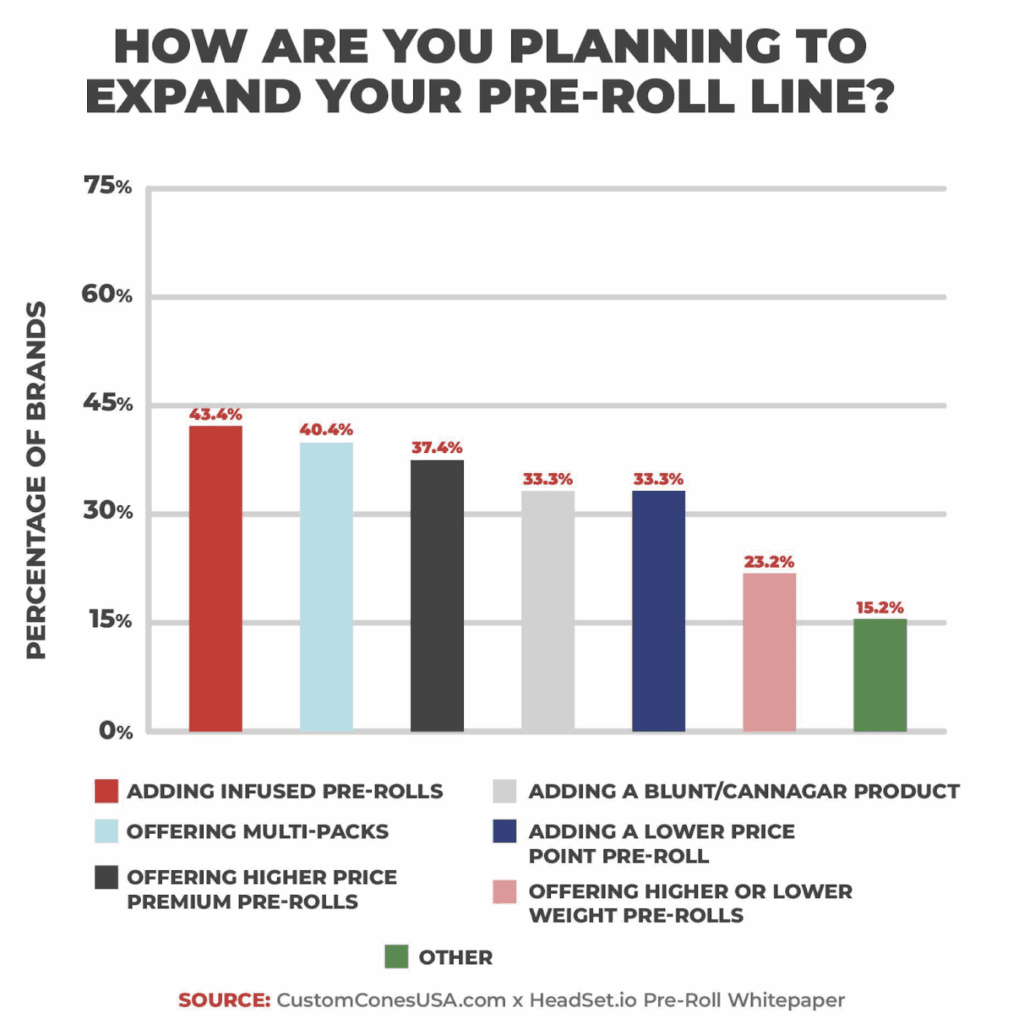

Approximately 300 U.S. pre-roll brands were surveyed in our 2024 U.S. report about how they plan to expand their pre-roll brands, and keeping up with trends in consumer preference, it’s no wonder that adding infused pre-rolls and multi-packs top the list.

Whether it be the dominance of multi-packs in Canada or the explosive growth of infused pre-rolls in the United States, producers are adapting to meet ever-evolving consumer preferences.

As we move into 2025, it is more and more clear that pre-rolls are shaping the future of the cannabis market on both sides of the border.

James Valentine is the communications and content marketing manager for Custom Cones USA and Daysavers.

Psychedelic Medicine Saved My Life After My Navy Career. Now Congress Must Act To Provide Access For Our Veterans (Op-Ed)

The post How Do The U.S. And Canadian Markets For Pre-Roll Marijuana Products Differ? (Op-Ed) appeared first on Marijuana Moment.