Marijuana Business Leaders Not Optimistic Rescheduling Will Happen This Year, Despite 97% Saying It’s ‘Important’ To Their Viability, Poll Shows

From toxifillers.com with love

Marijuana business leaders are not optimistic that federal rescheduling will happen this year—though 97 percent said the reform and the resulting federal tax relief are “important” to their “long-term viability”—according to a new poll.

Shield Compliance, which provides compliance management solutions for banks serving the legal cannabis industry, released the results of its 2025 Financial Services Survey on Wednesday, highlighting the “banking experiences and priorities” of state-licensed marijuana businesses.

Notably, the poll asked about the pending federal marijuana reclassification proposal to move marijuana from Schedule I to Schedule III of the Controlled Substances Act (CSA) that President Donald Trump recently said his administration will decide on imminently.

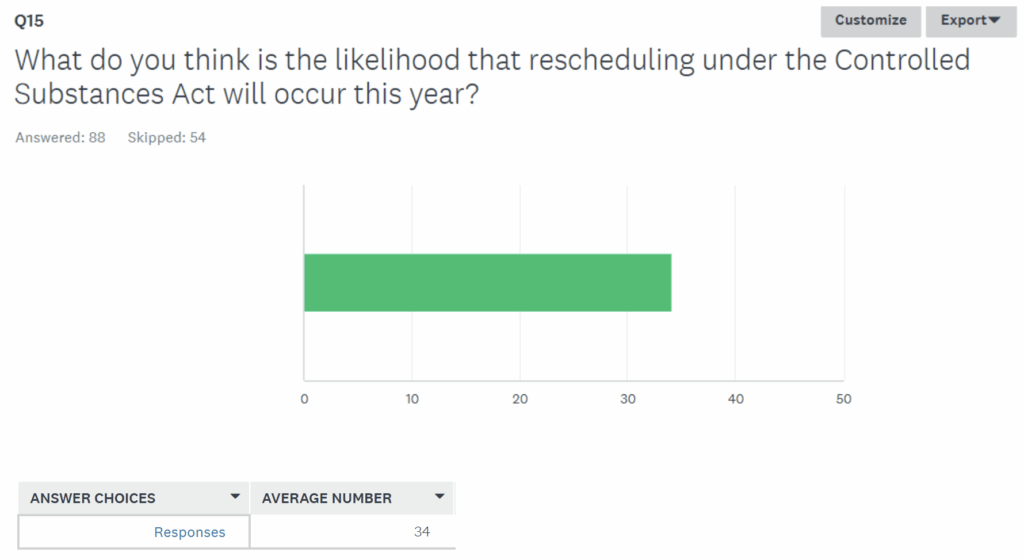

When asked to rate the prospects that rescheduling would be achieved this year on a scale from 0 to 100, the average response was just 34.

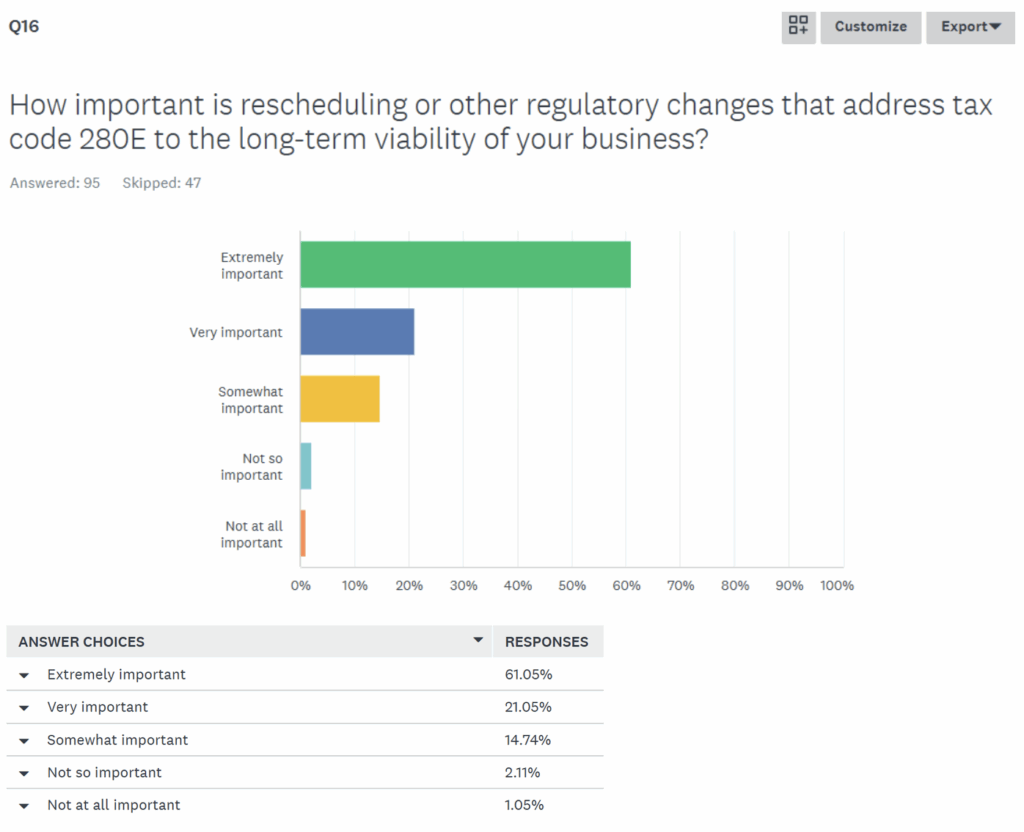

That’s in spite of the fact that the vast majority of respondents (about 97 percent) said that rescheduling—and the resulting federal tax relief—say the reforms are “important” to the “long-term viability” of their businesses.

That includes 61 percent who described them as “extremely important.”

The survey also showed that, while many marijuana businesses have struggled to access financial services under federal prohibition, most of those that have are evidently satisfied with their current providers, with more than 80 percent reporting satisfaction with their customer service and over 70 percent saying they’re content with compliance requirements.

Through there is that level of satisfaction, the poll, which had 142 respondents, also found that more than 60 percent of cannabis operators are eager for innovation around payment solutions. And almost 30 percent said they’re considering switching financial institutions next year to obtain access to credit.

“The survey results highlight a paradox in cannabis banking,” Tony Repanich, president and CEO of Shield Compliance, said in a press release. “Operators value their banking relationships yet demand for credit access and payments innovation underscores significant opportunities for financial institutions ready to lean in, particularly as the creditworthiness of operators improves with market consolidation and regulatory reform.”

But the broader issue of banking challenges in the marijuana industry persists. And while rescheduling would mean that the sector would no longer be prohibited from taking federal tax deductions under an Internal Revenue Service (IRS) code known as 280E, that wouldn’t resolve the underlying banking issue.

To that end, a bipartisan coalition of 32 state and territory attorneys general from across the U.S. recently called on Congress to pass a marijuana banking bill to free up financial services access for licensed cannabis businesses.

Meanwhile, the Democratic Senate sponsor of the Secure and Fair Enforcement Regulation (SAFER) Banking Act recently said that, despite efforts to coordinate meetings around the legislation, other priorities have taken precedence for now.

Asked about recent comments Sen. Bernie Moreno (R-OH)—the lead GOP sponsor of the SAFER Banking Act this session who told Marijuana Moment that he doesn’t expect the bill to come up until this fall—Sen. Jeff Merkley (D-OR) said, “Hopefully sooner than later in my mind.”

In January, the office of Rep. Dave Joyce (R-OH), who is again leading the effort on the House said, told Marijuana Moment that he would be filing the cannabis banking legislation this session but that its introduction was “not imminent” as some earlier reports had suggested.

—

Marijuana Moment is tracking hundreds of cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

A leading anti-marijuana group recently sounded the alarm about a possible attempt to put the cannabis banking measure in a cryptocurrency bill that was advancing on the Senate floor, but that didn’t come to fruition.

With Republicans in control of both chambers and key leadership positions filled by opponents of marijuana legalization, it’s been an open question about whether any cannabis reform legislation stands a chance of passage in the short-term. That’s despite the fact that Trump endorsed marijuana industry banking access, rescheduling and a Florida legalization initiative on the campaign trail.

On the House side, a Republican lawmaker said in March he’s hopeful that Congress will be able to get a marijuana banking bill across “the finish line” this session, arguing that the current barriers to financial services for the industry represent a “second tier” of prohibition.

Cannabis industry banking challenges came up in several congressional hearings in March, including a Senate Banking Committee meeting on debanking where senators on both sides of the aisle addressed the lack of financial services access for marijuana businesses.

Meanwhile, in January congressional researchers released a report detailing the subject of debanking—while making a point to address how the marijuana industry’s financial services access problem “sits at the nexus” of a state-federal policy conflict that complicates the debate.

Separately, the Government Accountability Office (GAO) announced in December that it’s convening focus groups comprised of marijuana businesses to better understand their experiences with access to banking services under federal prohibition.